-

Liability Coverage:

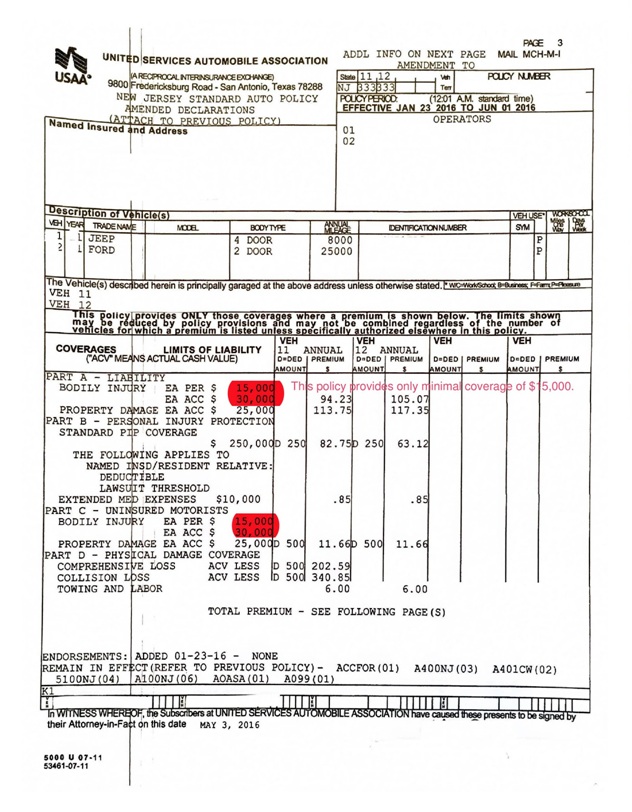

BODILY INJURY. This part of your auto policy covers you for liability: when you cause injury to another person while operating your vehicle. You should have coverage that is sufficient to cover you for any potential loss. Keep in mind that if you were found at fault for an accident and you insurance coverage was not sufficient to cover a damages verdict, you could be personally liable for the amount above your insurance coverage. For instance, if you had only $15,000 in Bodily Injury coverage, and caused damages of $100,000, then your personal assets would be at risk.

Depending on how the policy is written, the coverage will be either split-limits or a combined single limit policy. For instance a policy of $15,000 per person/$30,000 per accident means that your policy will only cover $15,000 for any one person injured in an accident, whereas $30,000 would be the most that could be paid out if there 3 people injured. A combined single limit policy of $30,000 means that whether its one person or 3 people injured, the most that can be paid out is $30,000.

TIP: CHOOSE THE COVERAGE THAT AT LEAST COVERS THE NET VALUE OF YOUR ASSETS. WE RECOMMEND COVERAGE OF AT LEAST $100,000. HOWEVER YOU SHOULD BUY AS MUCH COVERAGE AS YOU CAN AFFORD -

Uninsured/Underinsured Coverage:

BODILY INJURY. Uninsured Motorist covers you when someone else causes injury to you. If that other person does not have insurance, then your own insurance will provide you coverage and benefits up to the limits of your policy. Underinsured Motorist coverage provides additional coverage above the coverage of the person causing you injury but up to your own limits. For instance, if you are involved in an accident and sustain bodily injuries worth $50,000, and the person that caused your injuries only has $15,000 in coverage, then you have $35,000 in coverage available ($50,000 – $15,000= $35,000 in available Underinsured coverage.

TIP: THIS COVERAGE SHOULD BE AS HIGH AS YOUR LIABILITY COVERAGE. FOR INSTANCE, IF YOUR LIABILITY COVERAGE IS $100,000, THEN YOUR UNINSURED/UNDERINSURED COVERAGE SHOULD MATCH THAT AT $100,000 -

Medical Coverage:

This part of the policy covers your medical and hospital bills when you are involved in an accident. In New Jersey, we have a no-fault system in place for payment of medical bills while in an auto accident. This means, that regardless of whether you are at fault or the other driver, your own auto insurance pays for your medical bills up to the coverage you select. The maximum medical coverage you can select is $250,000. Lower limits are available ($15,000, $50,000, etc.) Keep in mind, if you medical expenses from an accident exceed the limits you chose, then would be responsible for payment of those additional medical expenses.

You can also choose to have your medical bills from an accident covered by your health insurance. If you choose the “Health as Primary” option for medical/PIP coverage, this means that your medical bills from a car accident would be paid by your health carrier first, before your auto insurance may be applicable.

TIP: CHOOSE $250,000 IN MEDICAL COVERAGE. MEDICAL EXPENSES FROM AN ACCIDENT CAN EASILY TOP A LOWER $15,000 POLICY LIMIT LEAVING YOU AT RISK OF BEING RESPONSIBLE FOR MEDICAL BILLS. WE ALSO RECOMMEND AGAINST CHOOSING HEALTH AS PRIMARY. MANY HEALTH PLANS HAVE LIMITATIONS ON THE TYPE OF TREATMENTS OR DOCTORS THAT YOU SEE WHICH WOULD THEN CAUSE THE AUTO INSURANCE TO KICK IN AS SECONDARY PAYER CAUSING CONFUSION AND BILLS NOT GETTING PROCESSED AND PAID PROPERLY.

SEE THE TWO (2) SAMPLE DECLARATIONS PAGES BELOW SHOWING

HOW THE DIFFERENT COVERAGES LOOK.